One of the perks of a new job are the new toys. In this case, my new employer has given me a Lenovo Helix and an iPhone 5s. I am familiar with Windows laptop/tablet hybrids, owning a Surface Pro, but I have never owned an iPhone before so it has been a bit of a learning curve. One of the drawcards of iPhones are the masses of free apps available, so I dived right in to work out the best ones.

This list is the distillation of a bunch of “best apps for business” articles, the relevant top 150 categories in the iStore and the apps I already have running on my Windows Phone (I used my personal phone in my last job). Here we go…

Miscellaneous Work Apps

General apps which make the little things at work a little easier

HelloSign

As a Windows user, PDF documents needing a signature ARE a hassle. You print them off, sign them, rescan them and then send them on. With HelloSign you import a PDf file into the app, add a signature and email it on. Too handy, and perfect when you need to turn documents around quickly.

Expensify

Take photos of your receipts and it will auto-scan them for the totals and the merchant. You then collate them into ‘reports’ for your expense reporting. Too easy.

Dragon Dictation

An interesting app that automatically translates what you say into text for distribution on various channels e.g. SMS, social or email. It even works with my Australian accent.

Voice Memos

A default app which lets you record your vocal pearls of wisdom and then share them through messaging or mail channels as an m4a sound file. Great for recording those good ideas or blog topics when a pen is not in reach.

Media

These are the apps to mostly do with traditional media e.g. books and newspapers.

Newsstand

Part of the default set of apps that came with the phone, this gives you some reading time when at those airport gates. Unfortunately many of the more popular titles give you one free magazine and then need you to pay to subscribe. Also, if your company has disabled iCloud on the phone, some titles will not work. One title which was free was “Whisky Magazine” which was a special edition covering American Whiskeys. Apparently I need to check out Woodinville in Washington state, a small drive out of Seattle when I go to the MVP Summit.

Flipboard

Similar to Newsstand, pick the topics and Flipboard will serve you articles to while away the hours in transit.

iBooks

The default book app for the phone, there are free books worth a browse. In my case “Dr Karl’s Little Book of Trivia 101”

Podcasts

If the previous options hold no thrall, another default app is Podcasts with an excellent array of audio and video podcasts to choose from. For me, Good Game and Dr Karl on Triplej. Yes, I am quite the fan of Dr Karl.

Pandora

My preferred music streaming service of choice. Give it a song and it will build you a playlist. If you are looking to relax after a tough day in the office, feed Pandora your favourite chill-out track and see what comes back.

Netflix

I recently blogged about how I am a fan of my new Netflix service. When music is not soothing the savage beast, kick back with a great range of television shows and movies (for a subscription fee). Awesome for hotel rooms where the television service does not quite pass muster.

Photos

The default photo app. This is where your receipt photos from Expensify end up.

Social

Apps for communication on various channels outside of the traditional phone and email.

LinkedIn

If you are not on LinkedIn, you should be. Traditionally hailed as the tool of choice for lazy recruiters, I find it invaluable as a networking/sales tool. Curious about whether that old client is still with that company where you implemented CRM? Check them out on LinkedIn. Want to distribute your blog article to hundreds of professionals who might be interested? Post into a LinkedIn group.

Skype

Now owned by Microsoft, the pervasive VOIP service is ideal for making cheap calls on your phone while overseas. Just make sure it is using the local Wi-Fi service and not the carrier’s data service otherwise you may need to mortgage your home to pay for the call.

Twitter

Another social channel I embrace (@leontribe for those interested), Twitter is SMS for the internet with all messages being public. Great for research on people and organisations and also a great way to consume information on practically any topic of interest.

Facebook

Often maligned as a productivity killer, there are actually many of corporate and professional pages on Facebook. The Microsoft Dynamics CRM Facebook group is an excellent group rivalling the forums for the quality of responses to questions from end users.

Messenger

The same messaging system that appears in Facebook is my preferred instant messaging tool on the iPhone. With this tool you get access to all of your Facebook friends without Facebook being permanently open. For all of the CRM MVPs around the world, Messenger is my tool of choice for reaching them for a quick question about Dynamics CRM.

Messages

This is the iPhone’s default messaging tool. By default it uses the iMessage system which means when you are talking to other iDevices, it does not use SMS for communication. Therefore, to keep the message channel consistent you might want to disable the iMessage option in the settings.

FaceTime

Another default app which I am yet to explore in detail. I understand it is a video chatting application similar to the video chatting feature of Skype. Given Skype does the job I will probably stick with that but it is there for those more used to the Apple way.

GroupMe

This is a group messaging system which allows you to create groups and message within that group. We use it at the MVP Summits to keep in touch but I imagine it will be eventually replaced by one of the other tools above. Not necessarily an essential app but it is one I use.

Office

These are the Microsoft Office and related apps which, even on the iPhone, leave the imitators for dust.

Outlook

I had the pleasure of trying out the Outlook app for Android and love it for what it is. It is not a patch on the Windows equivalent but it does have one feature which the Windows version does not, which is the “Focused” option. The Focused tab shows the emails in your inbox you really need to see as opposed to the regular missives from stores, those interest groups you belong to and so on. How it works it out I am not sure but it does a pretty good job. If I have half an hour at home to see if there is an important email in my inbox, I reach for the Samsung, not the Surface.

Fortunately, the Apple version of Outlook has the same feature. Instead of getting up to date on my Facebook wall while heading to work, with my iPhone I now check my Focused inbox. Microsoft need to bring this to Windows Outlook and, hopefully, they will very soon.

In terms of how it compares to iPhone Mail app, one annoyance for me with Mail was having to set up mailboxes to see other folders. The ability to merge inboxes is nice though in the iPhone Mail app and something worth having in the Outlook app. Overall though I think my preferences are more down to familiarity than any inherent gap in either product.

Excel, Word, PowerPoint

I doubt I will be creating any of these on the iPhone but they are there so I can read the files that come into my inbox. You can also link these apps to the OneDrive, OneDrive for Business and SharePoint services to access files there but be careful not to violate corporate policies by storing work documents on these, if your company has such a policy.

OneDrive

OneDrive is an inexpensive cloud storage option and does the job. You can even stream mp4 movies from it, if so inclined. Again, an option in hotel rooms or Wi-Fi enabled transit lounges. Also, remember to comply with corporate policy if they have rules about storing files on third-party cloud services.

Lync 2013

Now known as “Skype for Business”, the app still bears the old name. I am struggling to get this app to connect to my work’s Lync server but, for the rest of you, try it. Even the staunchest of the anti-Microsoft crowd acknowledge how great Lync is. In terms of what it does, “Skype for Business” pretty much says it all; a corporate version of Skype where your ‘friends’ are your work colleagues and, if federated, your customers and suppliers.

Transport

As a consultant we need to get about. Here are the apps to help.

Maps

The default map application for iPhone. Given all the bad press when it first came out, I will probably stick to the alternatives but I do believe Apple has worked hard to make it practical.

Google Maps

No compelling reason other than it is really good and does not rely on locally stored maps. You can be anywhere in the world and, if you have an internet connection, you will have a map.

Waze

GPS becomes social in this great little navigation tool. People report incidences real time and the app even detects if you are moving slower than you should on a road and asks if there is a problem. When I am in traffic and need an alternative route, I reach for Waze.

Uber

The app that is so effective people call for it to be banned. This is a taxi service from your phone. What I love is that I can link it to my corporate card, book my taxi through the app, the payment is automatically deducted from my card, and the receipt is emailed to me. It could not be simpler. Being a phone app you can also see how far away the taxi is and the app gives you an estimated time of arrival based on the distance.

Travel

The apps I use when travelling by plane.

QANTAS

Replace with whatever airline your company uses. These apps are great for online check-in and using your phone as a boarding pass.

Virgin Australia Entertain

Needed so you can connect your iPhone to the Virgin Australia entertainment system.

TripIt

A freemium app which you can send your pdf booking confirmations to and it will keep track of your flights. From there you can share the flight with loved ones or use it to check details when heading to the airport and the booking email is proving elusive. It also allows you to see who else is nearby when travelling, which is great when you are tired of ordering dinner for one.

SeatGuru

An app which helps you book your seat. Give it an airline and flight and it will tell you which seats you should book and which you should avoid.

TripAdvisor

I use this for one purpose only; to find a decent restaurant when travelling. Tell it to find the restaurants nearby and it will give you the list, how far away they are and how they rank. You can then read the reviews to make sure.

Stocard

A new app for me, it promises to keep track of all my loyalty cards. Having been in numerous hotels over the years for work, I have signed up to multiple hotel loyalty programs. Rather than carry around a stack of plastic cards I use infrequently, this app promises to keep them in one place. To get them in there there is even a scan feature to read the bar code on the card.

World Clock

The app for timeanddate.com, this allows you to set up a series of cities and, for each one, it will display the time and date for that city. Great for international calls or for working out when you can call the loved ones back home.

Games

While this is a business apps list, there is one game I will call out when you are travelling.

Ingress

Google’s app which combines Geocaching with Capture the Flag. The missions feature is a great way to explore an unfamiliar city and see a few landmarks on the way. There is the added bonus of helping the Resistance stop the enslavement of mankind by the Enlightened. Fight evil, get some exercise and adjust, through exposure to sunlight, to the local time zone. Who says playing games is bad for you?

CRM

Apps specific to Dynamics CRM

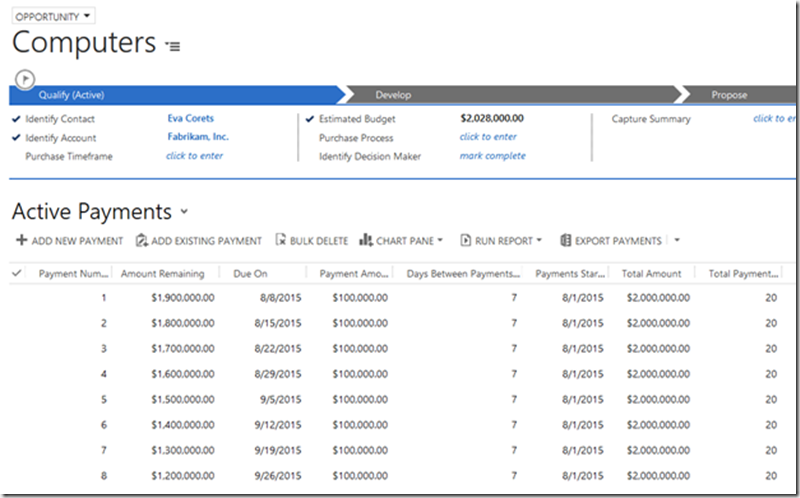

The Two Microsoft Dynamics CRM Apps from Microsoft

While there are a mountain of apps in the App Store which work with Dynamics CRM, there are two official ones from Microsoft. I am yet to set these up but it would be remiss of me, as an Dynamics CRM consultant, not to have them available in case of that impromptu demo we are sometimes required to do in elevators or at business events.

Miscellaneous Apps

Here are the rest which defy classification.

Roambi

I am yet to try it but so many “Must have” lists recommended it I was compelled to download it. Basically, you feed it a CSV file and it produces a presentation-quality graph which you can download and use.

Yahoo Weather

While the iPhone does come with its own weather app called Weather, the lists were also very complimentary of Yahoo Weather so I have downloaded it to see what the fuss is about.

Duolingo

If you are heading to a foreign country, this is a great little tool for learning a few words and phrases. In my case I am using it to keep my Spanish reasonably fresh. It is fun to use and very forgiving, recognising minor errors in accents and misspelling as small omissions, rather than marking them as completely wrong.

Converter+

A conversion app for surviving weights and measures in the USA.

Wi-Fi Finder

An app which locates paid and free hotspots. Ideal when overseas and you cannot use phone data.

Chrome

I am yet to meet an Apple user who rates Safari as a browser so I have downloaded Chrome.

Conclusions

So there you have it. There is my list of apps in my corporate iPhone to make my job easier. I am sure those of you with iPhones may have other suggestions so feel free to add them in the comments.