The end of another financial year draws to a close for Salesforce and, as usual, I am doing my post-game analysis. Unlike the previous quarter, Marc is being very consistent so, for people like me, looking for the patterns, they are easy to spot. Let us see how he fared.

The Numbers

As usual, the numbers come from Salesforce’s own website. They are the numbers reported to the US Securities and Exchange Commission using the ‘Generally Accepted Accounting Principles’ (GAAP). This is an accounting framework allowing analysts to compare companies on a level playing field. When giving press releases, these days, Marc shies away from GAAP and uses his own special brand of accounting which, not surprisingly, make the numbers look more favourable (referred to as Non-GAAP). This was not always the case. As can be seen in this Salesforce press release from 2009, Salesforce used to embrace GAAP reporting, until the truth got in the way of a good headline i.e. they stopped making a profit. I understand this from a public relations perspective but, from a business management perspective, I struggle to see the benefit.

| 2014 Q4 | 2015 Q1 | 2015 Q2 | 2015 Q3 | 2015 Q4 | |

| Revenue | 1,145,242 | 1,226,772 | 1,318,551 | 1,383,655 | 1,444,608 |

| Subscription Revenue | 1,075,001 | 1,147,306 | 1,232,587 | 1,288,513 | 1,345,358 |

| Revenue Cost | 273,530 | 292,305 | 307,831 | 333,211 | 355,923 |

| Operating Cost | 975,458 | 989,808 | 1,044,154 | 1,072,486 | 1,123,501 |

| Salesforce Income | -116,623 | -96,911 | -61,088 | -38,924 | -65,765 |

| Highest Transaction | 2,037,819,946 | 2,502,030,346 | 2,872,068,400 | ||

| Transaction Growth QoQ | 23% | 15% | |||

| Revenue Growth # YoY | 310,561 | 334,139 | 361,457 | 307,621 | 299,366 |

| Revenue Growth % YoY | 37% | 37% | 38% | 29% | 26% |

| Revenue Growth % QoQ | 6% | 7% | 7% | 5% | 4% |

| Total Cost % YoY | 46% | 37% | 36% | 20% | 18% |

| Staff | 13,312 | 14,239 | 15,145 | 15,458 | 16,227 |

| Staff Growth (YoY) | 36% | 38% | 20% | 21% | 22% |

| Margin | -10.18% | -7.90% | -4.63% | -2.81% | -4.55% |

| Growth Difference | -9% | 1% | 2% | 9% | 8% |

| Cash | 781,635 | 827,891 | 774,725 | 846,325 | 908,117 |

| Accounts Receivable | 1,360,837 | 684,155 | 834,323 | 794,590 | 1,905,506 |

| Cash/AR | 57% | 121% | 93% | 107% | 48% |

NB: I realised in writing this up that I had the wrong Salesforce income in place for 2014 Q4, being off by 13,000. It had no material impact on my analysis but I thought I would call it out before someone else did.

Apart from the staff and transaction numbers, all of the above are in the thousands. For the year, Salesforce generated around $5.4b in revenue and has made a big noise about being the fastest to five billion. As I have mentioned in the past, Salesforce is selling $10 notes for $9 which makes for strong sales but lousy profits.

Revenue growth is slowing (which I will look at later) but, thankfully, so are costs. As previously predicted a 20% year on year staff growth is now the new normal.

In terms of losses, for the full year, Salesforce lost around $260m

Cash has gone up but Accounts Receivable has skyrocketed. Again, I will look at this in more detail further in.

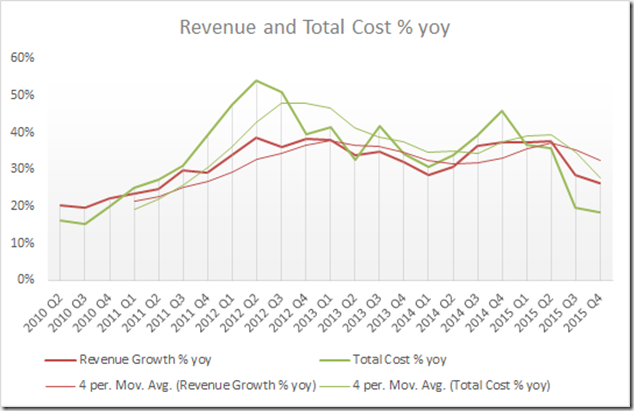

Revenue and Cost Growth

This is a good and bad news graph. Firstly the good news. Revenue growth is outpacing cost growth by 8%, about the same as last quarter. So while Salesforce is making a loss, this loss will reduce over time.

The bad news is growth is slowing. It is well and good to talk about Salesforce’s 26% year on year revenue growth (the first bullet point in their bold headline in the quarterly announcement) but what this fails to mention is this is the lowest it has been in almost five years. Compared to those Marc used to mock for their lack of cloud presence, Salesforce is slowing and is far from the triple figure growth of its competitors.

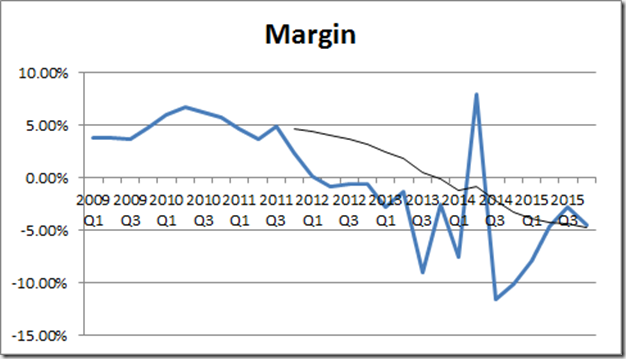

Margins

I am using a 12 period moving average to smooth out the variance. The advantage of the trending line is it is very difficult to glean insight from the numbers directly as they jump around so much. The trend graph suggests the deteriorating margins are slowing up and, if things continue, Salesforce will move towards profitability albeit slowly.

This is reinforced by the annual numbers. This year, Salesforce made an annual loss of around $260m, compared to $230m last financial year. In other words, they have increased their revenue by 33% but their loss has only increased by about one third of that. Perhaps this suggests there is a way for Salesforce to return to profitability through sheer size. It is very early days though and the loss would need to start decreasing year on year, rather than just growing slower than revenue for this to be realised.

Looking at the long term, other than when the IRS cashed in their tax credits, Salesforce has not turned a profit since 2012 Q1. The next quarter, using Salesforce’s terminology, is 2016 Q1. Therefore, if Salesforce fail to make a profit next quarter, it will literally have been four years since Salesforce made a buck from their operations.

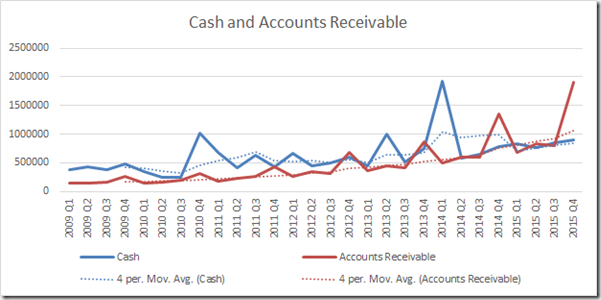

Cash and Accounts Receivable

The purpose here is to consider the quality of Salesforce’s current assets (assets which, in theory, could be cashed in quickly, if needed). The two major components for Salesforce are Cash (literally cash sitting in a bank account) and Accounts Receivable (money owed to them). Cash is generally considered more desirable than Accounts Receivable if only because it is much easier to get money out of the bank than it is to get money out of people who are in your debt.

The part jumping out at me here is the regular spike in Accounts Receivable (the red line). However, it is completely predictable, based on the historical values. At the end of every financial year, Accounts Receivable jumps up and every year the jump seems to be increasing. What is the cause of this mysterious pulse?

The answer is a human one. At Salesforce, “every month is end of quarter” so imagine how important the end of financial year is. The Salesforce sales team want to earn their commission and end the year on a high. If there is a way to close a sale before the end of the financial year, they will. In this case it is signing the contract before they have the money in hand. Terms of credit are extended significantly in the final financial quarter. What this tells me is if you are looking to get a good deal on Salesforce’s CRM, January is the month to play hard ball.

I also feel it is time to revisit the cash flows of Salesforce. How is it, if they are generating losses for so long that they continue to stay in business. Part of the story is the selling of shares to prop up operating cash flow but there is a bigger story around the ‘deferred revenues’. I think I will cover this in another blog article in the next few weeks.

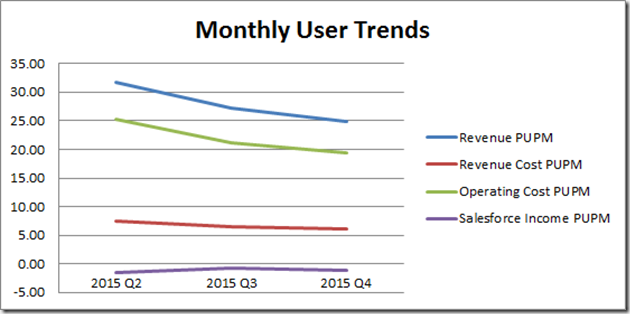

Subscribers

Based on the transactions, subscription growth has slowed from 23% to 15%. It is probably a bit early to say if this is a trend or an outlier but it is worth keeping an eye on.

The loss per user per month has gone up from about 75c to about $1.10, which is not great and defies a transition to profitability. Another one to keep an eye on.

Earnings Call Buzzword Bingo

| 2014 Q4 | 2015 Q1 | 2015 Q2 | 2015 Q3 | 2015 Q4 | |

| Number of words | 3700 | 2400 | 4731 | 3922 | 4017 |

| Customers/Customer | 25 | 22 | 38 | 34 | 23 |

| Revenue | 29 | 19 | 27 | 26 | 25 |

| Cloud | 14 | 15 | 22 | 47 | 32 |

| ExactTarget | 15 | 7 | 8 | 1 | 1 |

| Platform(s) | 12 | 10 | 13 | 27 | 18 |

| Service | 13 | 13 | 15 | 12 | 5 |

| Sales | 4 | 6 | 6 | 7 | 6 |

| Growth | 12 | 9 | 18 | 16 | 13 |

| Marketing | 11 | 5 | 10 | 8 | 4 |

| Cash | 16 | 10 | 11 | 9 | 10 |

| Operating | 10 | 11 | 11 | 8 | 20 |

| Enterprise(s) | 3 | 8 | 10 | 8 | 7 |

| Salesforce1 | 11 | 6 | 7 | 7 | 3 |

| Dreamforce | 11 | 14 | 2 | ||

| Analytics | 14 | 11 | |||

| Software | 12 |

The rule is the words on the list have had ten or more mentions in the past five periods with the text used being the call transcript after the introduction and up to, but not including, questions.

As we can see, we say farewell to ‘Sales’. The origin of Salesforce as a sales force automation platform is now well and truly in the past, although the Sales Cloud is still the main part of the Salesforce revenue. We also say hello to the word ‘Software’. Salesforce’s catchcry used to be “No Software” so it is a little surprising that the word Salesforce used to rally against is now a key part of Marc’s quarterly speech. Marc, in the quarterly announcement, refers to Salesforce as a “software company” seven times, obviously embracing the term he once reviled.

In terms of words in danger, we have ExactTarget, the acquired marketing automation platform and Salesforce1 which Marc refers to as the “foundation of everything we do”. It may be the foundation but it is the cloud, revenue and the customers which are at the front of his mind.

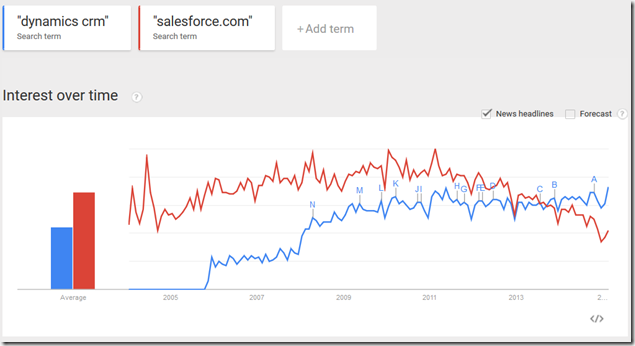

Google Trends

The term “dynamics crm” continues to have more interest than “salesforce.com” globally. Moreover, while the term “dynamics crm” is the most popular it has ever been, the term “salesforce.com” is generating the least interest ever, with the graph going back ten years.

Google Trends could not generate the region trends so I cannot include these this quarter.

Insider and Institutional Sales

| 2014 Q4 | 2015 Q1 | 2015 Q2 | 2015 Q3 | 2015 Q4 | |

| Insider Sales | 0.50% | 0.50% | 0.40% | 4.70% | 4.60% |

| Institutional Sales | 2.72% | 2.71% | 2.67% | 3.20% | 3.11% |

The big sales we saw last quarter continue. In 2015, so far, Marc Benioff has sold off close to half a million shares worth about $27m. Here are all of the sales for this year, to date.

| Insider | Value of Shares | Number of Shares |

| Marc Benioff | 27,299,125 | 462,500 |

| Parker Harris | 3,631,752 | 75,408 |

| Joe Allanson | 26,384 | 418 |

| Burke Norton | 1,465,560 | 24,372 |

| Maria Martinez | 120,117 | 1,903 |

| Craig Conway | 59,865 | 1,000 |

| Lawrence Tomlinson | 379,528 | 6,400 |

| Alexandre Dayon | 142,857 | 2,500 |

| Grand Total | 33,125,188 | 574,501 |

To give some perspective the largest sales are by:

- Marc Benioff, Chairman and CEO

- Parker Harris, Co-Founder

- Burke Norton, Chief Legal Officer

Two of the co-founders are off-loading despite one of the analysts on the call likening the quarterly results to the Lego movie song “Everything is awesome”. For some reason Benioff and Harris no longer want to be ‘part of the team’.

Looking to the Future

Last quarter I predicted revenues of $1.46b-1.48b and an operations loss of around $20m. I was off on the revenue, which was $1.44b, by around 1%, which I am quite pleased about. For the operations loss, it was almost $65m so I was much less accurate. I thought the ship would be steering towards profitability a lot quicker than it is.

For next quarter, I predict revenues of $1.56b and a loss of around $50m.

Conclusions

Almost a year ago, I used Newton’s First law as an analogy to the lack of desire of Salesforce’s management to change direction. This time around I will use Newton’s Second Law which states that the force needed to accelerate an object is proportionate to the mass of the object. In other words Force equals = mass times acceleration. In this case, the ‘mass’ is the financial size of Salesforce and the acceleration is the growth of the organisation.

Warren Buffet talks in his annual reports about how it is very hard for him to generate the returns of the past because Berkshire Hathaway is now so large. The same is true for Salesforce. A number of indicators are suggesting a slowing of growth (revenue growth has slowed, staff number growth is slowing and transaction growth is possibly slowing). There is no mystery to why growth is slowing; what was once an untapped market is becoming crowded. New opportunities are harder to find and those that are available are being aggressively pursued by the competition. The effort required to grow the business (force) is now much larger because of their previous success (their mass).

As Salesforce becomes a mainstream “enterprise software company”, it begins to face the same challenges as its competitors. Ten years ago, Benioff famously said of his mainstream competitor Siebel “Even dinosaurs mate a few times before they die. It's the end of software.” Today, Salesforce is becoming one of those behemoths he once had disdain for. The big question is will Salesforce evolve into a bird and soar or will it become a lumbering carnivore doomed to be a collection of bones in the fossil record.

No comments:

Post a Comment