This week I was going to do an update on the subscription numbers for Dynamics CRM and salesforce. However, the Q2 results of salesforce have something in them which means the numbers will have to wait another week.

Salesforce’s Q2 Announcement

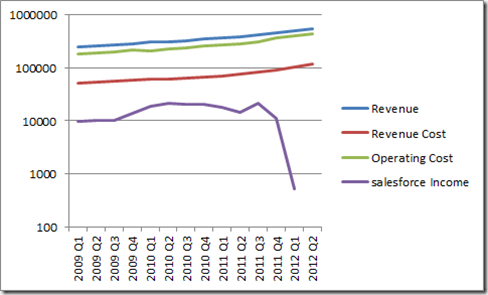

If you want to see my thoughts on the salesforce financials, I recently wrote this blog. However, there is something disturbing, beyond the financials, in the latest update which is worth calling out. To see the Q2 results, here is the link. Here is a high level graph of the financials thanks to this nice summary.

The scale on the left is a logarithmic scale. This is not smoke and mirrors, it just makes the issue at hand really, really obvious. Because the most recent quarter was a loss it does not show here (log scales cannot handle negative numbers). We can look at a normal linear scale to see the same data with the latest quarter included.

So, first we play a game of spot the difference and see that while revenues and costs are moving in the same direction, because total costs are growing faster than revenues, the income is dropping. Salesforce is not demonstrating any economies of scale. In fact, they are acting like a reverse internet start-up. Generally internet start-ups run at a loss initially and then become profitable as they scale. Salesforce is doing the opposite.

However, the problem I have is not that salesforce is making a loss, although that is not good for any business. The problem is not that cash is flowing out of the business rather than in (as evidenced by the Q2 cashflow statement). The problem is not that salesforce promotes non-GAAP reporting which excludes the cost of giving shares to employees as compensation to ‘align their interests with those of our stockholders’ (here is Warren Buffett’s thoughts on hiding stock-based expenses).

The problem is they are not calling out the fact they are losing money and explaining what they are going to do about it in the long term.

The six bulleted highlights for Q2 mention nothing of making a loss for the first time in at least two years. Three of them refer to revenues (which are up), two of them talk about customer numbers (which are up) and the final one talks about operational cashflow (which is up but is dwarfed by the massive cash leaving the business through their purchase of Radian6).

I will not exhaustively go through the rest of the text other than to summarize each section with a bullet point.

- Dreamforce plug

- Revenue

- Earnings Per Share (a heady combination of GAAP and non-GAAP numbers without reconciliation)

- Customers

- Cash (nothing about the overall loss)

- Deferred revenue

- Guidance

- GAAP – non-GAAP reconciliation per share

- Conference Call plug

- Salesforce plug

- A big section on their use of non-GAAP measures “Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures”

- Safe Harbour Statement

- Financial statements

- Unaudited additional metrics

- GAP – non-GAAP reconciliation (seems strange to have this right down the end but maybe it is normal)

Other than the financial statements, if you were to follow the text, you would think everything was fantastic for salesforce and there was nothing to stop them flourishing. Incidentally, GAAP is simply a convention on how to present financial information so that different company financials can be compared. Non-GAAP accounting is a divergence from this convention.

What About The Earnings Call Transcript?

You can read the transcript here. One disappointment in there is they say they will not be reporting customer numbers any more so my upcoming update of the subscription numbers will be the last for quite a while. While I can understand that the acquisitions will make the numbers a little muddy, even indications would be nice.

By their own admission, figures discussed in the call were non-GAAP. If “non-GAAP financial measures are not meant to be considered in isolation” why would they do this?

So what did Marc Benioff, Chairman and CEO of salesforce have to say about the financial loss? Here is a summary:

- considers the Q2 results to be ‘strong’

- talked about revenue growth justifying their growth strategy

- talked about non-GAAP earnings (not mentioning the GAAP loss), revenue, operating cashflow and customer numbers

- talked about some big deals signed

- talked about his travels

- talked about the cloud

- talked about some more recent deals

- talked about Chatter and Force.com

- talked about the market potential

- talked about Forrester’s predictions

- talked about Dreamforce

In short, nothing about the loss in earnings.

Next was Graham Smith, CFO of salesforce. Here is what he said:

- considered it an ‘exceptionally strong quarter’

- talked about revenue and the drivers behind it

- talked about revenue from different regions

- talked about what the components of the revenue were

- talked about their non-GAAP gross margin

- talked about expenses, admitting they were up, attributing it to mergers and acquisitions and ‘aggressive hiring’

- talked about how ‘aggressive hiring’ would continue for the rest of the year

- talked about how R&D is the fastest growing expense and this ‘investment’ would continue

- talked about how sales and marketing expenses were up and suggested this expense would continue for ‘building awareness’

- mentioned a legal settlement which he quantified in per share terms but not in dollar terms

- talked about how general and administrative expense had increased and how they intend to reduce it ‘in the long term’

- talked about how the non-GAAP operating margin was down which was attributed to acquisition

- talked about the non-GAAP tax rate

- talked about non-GAAP earnings per share

- talked about operating cash flow

- talked about capital expenses due to acquiring office space

- talked about cash being down, due to acquisition

- talked about deferred revenue

- talked about receivables

- talked about the Radian6 acquisition

- talked about non-GAAP guidance

- talked about Dreamforce

The GAAP loss did not rate a mention. The closest to a profit strategy was the intent to reduce the general and administrative expenses, but that was it. No comprehensive strategy was mentioned for bringing the company back into profit. Nothing specific was mentioned for arresting the growth rate of expenses, relative to revenues.

What About The Q&A?

After the presentation, the audience of analysts had an opportunity to ask questions. Mark Moerdler from Sanford C. Bernstein & Co, Inc. got to the crux of the matter, forcing the issue of GAAP profit. Asking about the expected loss for the full year (around 10c per share) he asked what contributed to this. For more of Moerdler’s thoughts on salesforce, there is this nice summary.

Marc Benioff replied and made it clear why there is no focus on the loss and, in fact, why it is actively ignored (along with Moerdler’s question). Here are a few quotes:

- “my job … is not to focus on that GAAP profit number”

- “if we were focused on the GAAP number … we would be probably running a much leaner machine”

- “the ultimate number and the most important number is the top line” (this means revenue)

To translate, at this point, Marc has no interest in ensuring salesforce runs at a profit. His focus is on revenue (top line) growth. The problem I have with this is there is no talk of how the company will move to profitability or how long they can run at a loss. The non-GAAP accounting simply gives us the measures salesforce believe are important for its future success. The GAAP numbers tell us what is needed now to run a profitable business and the fact is salesforce is not profitable and, based on the trends in my graphs, it will not be so for quite a while.

So Why Is It Such A Big Deal To Be Profitable?

In the short term it is not such a big deal. If you suffer a loss in a quarter, you simply dip into your cash reserves to cover the difference. The problems occur if this is on-going. If you continue to dip into your cash either you run out of cash (also known as bankruptcy) or you must find more cash (generally through borrowing from a bank or issuing more shares). If this continues either the banks refuse to lend because they are not confident you can pay them back or the share price drops so low as to be worthless.

For three plain English measures to ward off bankruptcy, here is an article worth reading. While salesforce has plenty of cash (around half a billion), the key concern I have is that of viability (over time the business must be profitable). It is well and good sacrificing profit for growth but there must be a plan for long term profitability and I cannot see it.

Surely Those Stock Options Are Aligning Staff To The Shareholders So Profits Will Come

This is where things get a little troublesome. Warren Buffett calls out the fundamental problem with stock options as a tool for behaviour control; while normal shareholders have used their own cash to buy their shares, stock option recipients sacrifice nothing for their options; they have no skin in the game. Moreover, the goal of a stock option holder is to get the share price as high as possible at the point where they can exercise the option (buy the share) as they can then immediately sell the share for a profit. This is not necessarily the same as ensuring the future viability and prosperity of an organisation, which is the goal of a long term shareholder.

At this point let me put a massive disclaimer here. Firstly, I have no position in salesforce stock and have no intention of getting one in the next 72 hours (which is the disclaimer I see on other blogs like this one). Secondly, what I present is not an allegation, simply a discussion of how stock options can lead to poor behaviour.

Firstly, if we see employees of a company receive shares through options and then immediately sell them, this has to be for one of two reasons:

- they need the cash or

- they believe the price will go no higher

There have been a lot of sales by directors at salesforce. You can see them all here. In fact, the CFO from the quarterly update is one of them. Unfortunately in terms of buys, there appear to be none happening. In contrast to selling, people buy shares when:

- they have the cash

- they think the price will go higher

For our inside sellers, the motivation is to ensure, on the day of sale, the share price is as high as possible. Therefore, they are not motivated to talk about financial loss and expenses growing faster than revenues because this could lead to the share price dropping. Moreover, they are not motivated to change the formula for ‘success’ as this could affect market perception and also kill the share price.

While I am sure salesforce does have a strong desire for revenue and are deeply focussed on the idea of ‘build it and the profits will come’, with the structures in place, there is no motivation for anyone receiving stock options to question how much growth is sustainable for the business and whether salesforce should focus resources on stemming expenses over growing revenues.

Incidentally, the accountants do have a measure of a sustainable growth rate. This is the rate at which a company can grow its revenues without borrowing additional money. My calculations put this at 9% for salesforce, in contrast to their growth rate for Q2 of 38% year on year.

Conclusions

Salesforce is very happy with their Q2 results and, while revenue growth is great, it must be sustainable. To be sustainable, focus must be given to long term profitability. In the case of salesforce, the CEO is clear that profitability is not his focus at this time. To this end, salesforce has other measures which they use to monitor the health of the business, the so-called non-GAAP measures and while these measures may provide an insight which GAAP measures do not, they do not make $1 equal $2. The business still made a loss this quarter for the first time in over two years.

While a cynical man may assert that their pre-occupation with the non-GAAP accounting is, in part, driven by their motivation to deliver good news to the market and maintain the share price for exercising their stocks, I do not personally believe this to be the case. I believe Marc and Graham are just very optimistic about salesforce’s future, based on their non-GAAP measures, and the directors of the company are offloading their shares simply because they need the money in these hard times.

The problem is, while I want optimism in my directors, if I was a traditional shareholder, I would like to know that salesforce do not have their head in the sand in regards to their financials and have a plan for long term profitability. I would also want this clearly communicated as part the quarterly updates.

As an extreme example, let us say I start a business tomorrow where I sell $10 notes for $9. I imagine my customer base would grow rapidly (like salesforce). I imagine my revenues would also grow rapidly (like salesforce). I imagine my costs would also grow in line with my revenues (like salesforce) but this does not alter the fact that every time I am selling a $10 bill I am making a loss and selling more of them will only increase my loss. Even if I create different accounting measures which more accurately reflect the health of my business as I see it, the fact is I am buying something for $10 and selling it for $9 and, unless I change something, my business will never be sustainable and I will go bankrupt.

I like salesforce as a competitor and I want them to be around for a long time to come. Therefore I do not want them to sell something for $9 which is costing $10 to supply, because it is simply not sustainable.

No comments:

Post a Comment